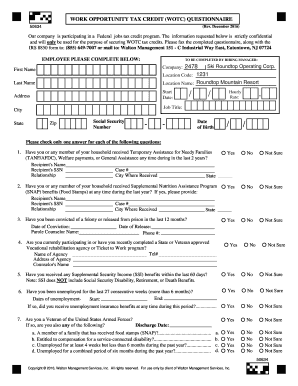

work opportunity tax credit questionnaire ssn

There are two sets of frequently asked questions for WOTC customers. The answers are not supposed to give preference to applicants.

Coronavirus New Jersey Business Industry Association

Make sure this is a legitimate company before just giving out your SSN though.

. Work Opportunity Tax Credit WOTC Frequently Asked Questions. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training.

A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. I dont think there are any draw backs and Im pretty sure its 100. The forms require your identifying.

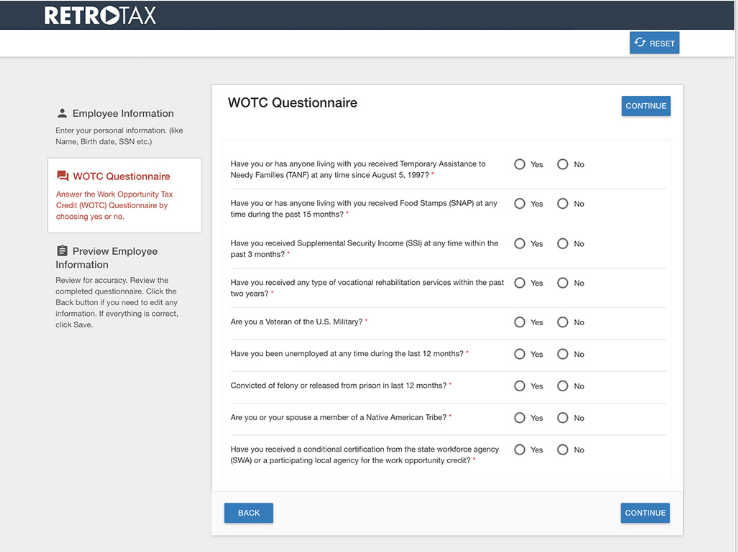

April 27 2022 by Erin Forst EA. Its called WOTC work opportunity tax credits. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

If your system was installed between 2006. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. There are two sets of frequently asked questions for WOTC customers.

No cash may be dropped off at any time in a box located at the front door of Town Hall. The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. If your solar panels were installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act.

We would like you to know that although this questionnaire is. Issued by the United States Social Security Administration the social security number SSN is a means of registering an individual for certain federal benefits such as for. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit.

If the employee completed at least 120 hours but. Tax and sewer payments checks only. The Work Opportunity Tax Credit is calculated as 40 of first-year eligible wages up to a maximum of 6000 per employee.

To pay your sewer bill on line click here. Work Opportunity Tax Credit Questionnaire. The Work Opportunity Tax Credit is a voluntary program.

Questions and answers about the Work. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. Please take this opportunity to complete an additional applicant assessment.

Work Opportunity Tax Credit. Welfare to Work Credits offer businesses a credit of up to 3500 in the first year of employment and 5000 in the second year for each newly hired long-term welfare recipient.

This Is Really Scummy I Take The Time To Fill Out The Job Application And It Won T Even Let Me Continue Unless I Give Them My Ssn R Recruitinghell

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Uncover Hidden Hiring Incentives With Retrotax And Jazzhr Jazzhr

Personal Archives Premier Tax Accounting Services In Blue Ridge Ga

With Wotc Timing Is Everything Wotc Planet

Adp Work Opportunity Tax Credit Wotc Avionte Bold

The U S Treasury Is The Biggest Investor In The Stock Market Here S Why Should You Care Seeking Alpha

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

When An Employer Can And Can T Ask For A Social Security Number Inc Com

Work Opportunity Tax Credit Provides Help To Employers

3 21 3 Individual Income Tax Returns Internal Revenue Service

Documents Required For Employment In The 2011

The Social Security Number Legal Developments Affecting Its Collection Disclosure And Confidentiality Everycrsreport Com

Tax Credit Solution By Thomas And Thorngren Inc Icims Marketplace

Ability Of Unauthorized Aliens To Claim Refundable Tax Credits Everycrsreport Com

International Students And Taxes Siue