dc auto sales tax

For more information visit the FAQ page. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local.

New Cadillac And Used Car Dealer In Queensbury Ny D Ella Cadillac

The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575.

. Masks are still required at DC. There are few exceptions to this. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees.

Effective October 1 the Washington DC Office of Tax and Revenue increased the sales and use tax rate to 1025 from 1000 for leased vehicles. Title 25 Chapter 9. A properly filled out vehicle bill of sale in DC may also be necessary for conducting official business with the Department of Motor Vehicles DMV.

Most new car dealerships will collect the excise tax in addition to the registration fees and take all the necessary steps to have the vehicle titled and registered on your behalf. To register a vehicle that weighs 55000 lbs or more you will have to pay a Heavy Vehicle Use Tax. Current Tax Rate s Beer 279 per barrel Champagnesparkling wine 045 per gallon Distilled Spirits 150 per gallon Light wine.

Sales tax details The Washington DC sales tax rate is 6 effective October 1 2013. Washington DC The District of Columbia Office of Tax and Revenue OTR reminds tax professionals software providers businesses and others about tax rate changes that will. Use tax is imposed at the same rate as the sales tax.

For the most accurate sales tax rate use an exact street address. Title 47 Chapters 20 and 22. The Washington DC sales.

The updated excise tax rates will take into account the fuel efficiency of motor. 2015 Sales and Use. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone.

Please adjust your systems. 2022 District of Columbia state sales tax. This is a single.

2015 Sales and Use Tax Annual Return Booklet for Use Tax Filers. New Sales and Use Tax Rates Effective October 1 Friday September 30 2011 Washington DC - Effective October 1 an increase in the District of Columbia Sales and Use. As a result of recent regulatory changes DC DMV has revised the calculations for motor vehicle excise taxes.

Exact tax amount may vary for different items. In addition there are also four tiers of excise taxes levied against a new car or truck. Special Considerations for Leases and Liens If your.

File your return and pay any tax due on or before the 20th day of October 2015. A sales tax of 6 percent is charged on the MSRP of any new vehicle purchased in Washington DC. Review our excise tax exemption list Rates are.

Do not use the sales tax forms to report and pay the gross receipts tax. Review our excise tax exemption list Rates are.

Nj Car Sales Tax Everything You Need To Know

Global Tax Agreement Will Set 15 Minimum Rate The New York Times

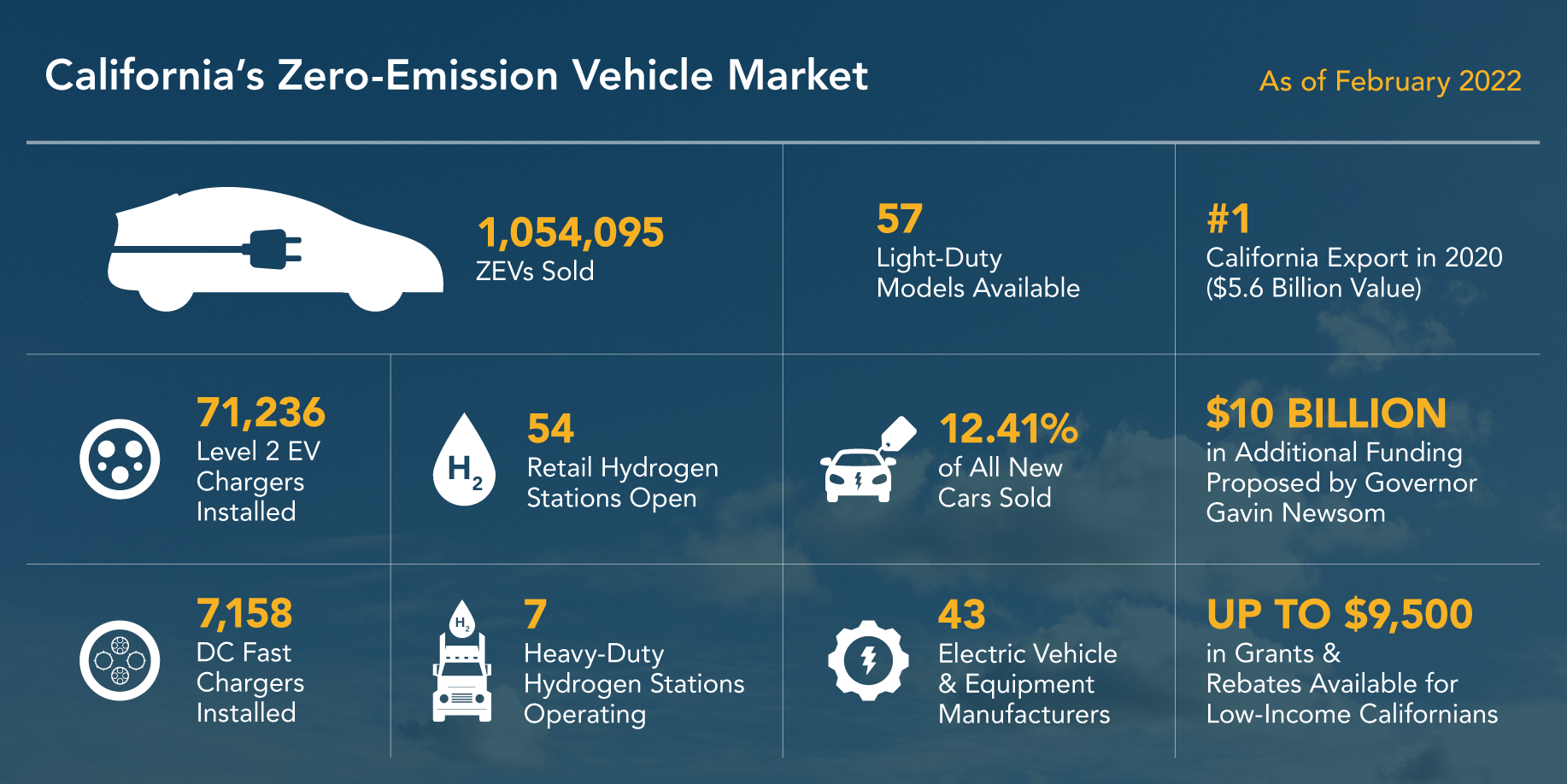

California Leads The Nation S Zev Market Surpassing 1 Million Electric Vehicles Sold California Governor

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Washington D C And Federal Tax Credits For Electric Vehicles Pohanka Automotive Group

Used 2012 Toyota Sienna For Sale In Washington Dc Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

Chevrolet For Sale In Falls Of Rough Ky Dc Motors

Used Mazda Mx 5 Miata For Sale In Washington Dc Cargurus

Montgomery County Sales Tax Could Increase By 0 25 Percent

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

New Us Ev Tax Credit Here S Everything You Need To Know

Used Toyota Prius V For Sale In Washington Dc Cargurus

How Do State And Local Sales Taxes Work Tax Policy Center

California Moves To Ban Sales Of New Gas Powered Cars By 2035 Npr

Bmw Of Sterling Bmw Dealership Service Center In The Greater Dc Metro Area

/cloudfront-us-east-1.images.arcpublishing.com/gray/6LEY6LSRAZBIRA5YE7BTIDOMBU.jpg)